Building Your Vision Into Tangible Outcomes

Dream Homes | Expert Property Solutions

Company Overview

RockPillar Property Limited (RPP), under RockPillar Ventures Limited, is a UK-based property developer focused on medium-sized conversion projects. We specialize in transforming existing properties into profitable residential and commercial assets, ensuring high-quality developments that deliver strong returns. Our goal is to generate significant value for investors by targeting high-profit margin projects that also offer strong rental returns.

• Target Project Size: £25 million Gross Development Value (GDV)

• Key Focus: Property conversion projects

• Location Focus: UK, with a particular emphasis on regions like Manchester and surrounding areas

• Team: Our experienced team has deep industry connections, including sourcing agents, construction firms, surveyors, lawyers, property managers, and local councils

Business Model

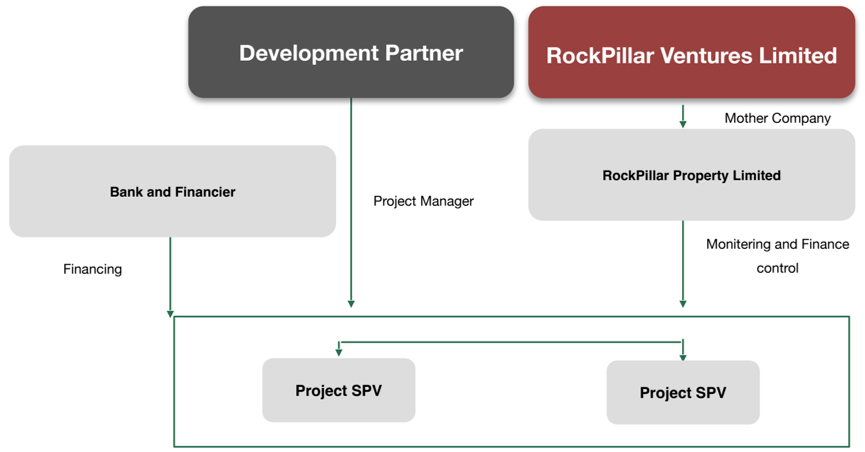

Company Structure

The co-development structure involves RockPillar Ventures Limited as the mother company, overseeing financial and operational aspects through its subsidiary, RockPillar Property Limited, which is responsible for monitoring and finance control. Development Partner takes on the role of project manager, handling the direct management of the project. Funding for the development is provided by a Bank and Financier, which supplies financing to two Project SPVs (Special Purpose Vehicles) created specifically for the project. These SPVs are jointly developed by RockPillar Ventures Limited and Development Partner, ensuring a collaborative approach to theproject’s execution.

Market Opportunity

The UK property market offers a wealth of opportunities for the RPP Co-developer with local experienced developer By leveraging their combined expertise, financial strength, and market knowledge, the JV is well-positioned to capitalize on these opportunities and achieve substantial growth and profitability. With a strategic focus on key market segments and a commitment to operational efficiency, the JV aims to become a leading player in the UK property development sector.

Strategic Market Collaboration

Targeting Key Segments

Focus on Efficiency

Our Management

Expertise in Real Estate and Financial Management

The management team brings a wealth of experience in financial

structuring, real estate development, and project management. Collectively, they have over two decades of expertise across key industries such as renewable energy, technology, agriculture, healthcare, and real estate. With significant knowledge in finance, private equity, and venture capital, they have successfully led complex development projects in both the UK and Hong Kong, overseeing contracts valued at over £110 million.

The team has a proven track record in strategic planning, project

execution, and risk management, ensuring that all ventures are completed on time and within budget. Their expertise covers market forecasting, financial analysis, regulatory compliance, and investor relations. With an in-depth understanding of building materials and construction methods, they ensure that all projects meet the highest standards of quality, safety, and structural integrity.

Focused on growth, the management team identifies high-potential

residential and commercial property opportunities in the UK and internationally. Leveraging their diverse backgrounds in finance, real estate, and construction, they drive the company’s vision of expanding its footprint, optimizing investment returns, and delivering sustainable, high-quality development projects. Their leadership ensures effective collaboration with local experts, contractors, and financial institutions to achieve long-term success.

Overview

RockPillar is a dynamic investment platform

with a global outlook, dedicated to uncovering and nurturing secure and promising investment opportunities worldwide. We are adept in conducting meticulous legal due diligence, establishing robust bonds with investment prospects, and crafting structures that foster long-term, secure, and compliant investment channels. Our core strength lies in our vigilant monitoring systems that safeguard investor interests while providing consistent funding support to our chosen companies and projects for their continuous growth and development.

Our Expertise

Team Highlights:

◦ Collaboration with development projects

◦ Over 1,000 property connections across sourcing agents, contractors, surveyors, and financiers

◦ Expertise in project investigation, risk management, and construction monitoring

Invitation Collaborate

We welcome visionary entrepreneurs and ambitious companies to explore the multitude of opportunities that our platform can offer. With RockPillar, rest assured that your journey toward financial success in UK great potential Property market is in capable hands.

UK Property Market Stability & Growth

The UK property market remains one of the most resilient and attractive destinations for real estate investments. Despite periodic market fluctuations, the long-term outlook has consistently demonstrated upward growth. Key factors contributing to this include:

• Increased Housing Demand: Due to a growing population, housing shortages, and delayed homeownership among younger generations, rental properties are in high demand, especially in key cities like Manchester, Birmingham, and Leeds (Cluttons) (The Star Sterling)

• Infrastructure Developments: Projects such as the HS2 rail network and urban regeneration initiatives have significantly boosted property values and rental demand, particularly in cities outside of London (Cluttons).

• Strong Rental Yields: Regional hubs like Manchester have consistently outperformed national averages with rental yields between 5-7%, offering investors higher returns compared to other markets (The Star Sterling).

The Great Manchester Property Market

This ongoing demand from overseas professionals helps secure stable rental income, particularly for properties that cater to modern, flexible living arrangements. Areas with high concentrations of expatriates, such as Manchester’s city center, continue to see robust rental yields, ensuring a strong return for investors (CBRE).

Manchester continues to be a thriving property investment hub due to its expanding economy, large student population, and consistent demand from overseas workers. It has experienced property price growth of over 30-40% in the last decade, with rental demand supported by the city’s vibrant economy, infrastructure development, and urban regeneration (Cluttons).

This trend is expected to continue, making it an ideal region for medium-sized conversion projects like those handled by RockPillar Property Limited. Overseas Labor and Impact on the Rental Market

The UK labor market has seen a significant increase in reliance on overseas workers to fill gaps, particularly in key sectors such as healthcare, technology, and hospitality. The consistent influx of international workers has created an enduring demand for rental properties, especially in major cities like London, Manchester, and Birmingham, where employment opportunities are abundant. As of 2024, the UK has seen record immigration numbers that support the demand for well-located rental housing (Landlord Today).

UK’s Education Sector: A Key Driver of Rental Demand

One of the UK’s most significant industries is its higher education sector, which attracts hundreds of thousands of international students every year. As one of the largest industries in the UK, the education sector not only contributes to the economy but also creates a substantial demand for rental properties. In 2023 alone, the UK hosted over 600,000 international students (Knight Frank), the majority of whom rely on the private rental market for accommodation.

Cities like Manchester, home to universities such as the University of Manchester and Manchester Metropolitan University, are prime locations for student housing. The rental demand from students is continuous, as every academic year brings new waves of students looking for housing. The average rent for student accommodations in Manchester has seen steady increases, with some areas reporting growth of over 20% year-on-year (Zoopla).

UK Rental Market: Steady Growth and High Demand

The UK rental market has experienced strong growth over recent years. Since the pandemic, rental prices have increased by 29% on average, with more than half of the rental properties now costing over £1,000 per month (Zoopla). In regions like the North West, which includes Greater Manchester, rental growth rates of 6.5% in 2023 are indicative of the strong demand and undersupply in these areas (Landlord Today).

As property prices increase and mortgages become less accessible, more people are turning to the rental market, further driving up demand. This environment creates opportunities for investors in the buy-to-let and property development sectors, especially when targeting high-demand regions like Manchester, where a combination of local professionals, international workers, and studen.ts fuels the market.

Investing in Manchester: High Returns and Strategic Location

Manchester stands out as a key market for property investors due to its rapid economic growth, ongoing urban regeneration projects,

and attractive rental yields. In areas like Salford Quays and the Northern Quarter, rental yields range from 5% to 7%, significantly above the national average (Landlord Today).

Manchester also benefits from major infrastructure projects like the HS2 rail link, which will further boost its connectivity and appeal.

UK Tax and Business Environment: Attractive for Investors

The UK offers a favorable tax and regulatory environment for property investors. Several tax incentives are available, particularly for investors focused on conversion and refurbishment projects, which can lead to lower capital gains taxes and additional deductions. Furthermore, the UK’s transparent legal system and stable business environment provide added security for international and domestic investors alike (The Star Sterling) (CBRE)

Project Strategy & Investment Approach

We aim to target medium-sized projects in prime or emerging areas with a GDV of £2-5 million, offering strong profit margins and rental returns. Our projects primarily focus on conversion and refurbishment of existing properties, which allows us to unlock value while minimizing the risks associated with ground-up developments

Key Differentiators:

• Conversion Expertise: Our team excels in identifying and executing conversion projects that transform underutilized properties into high-value assets.

• Profitability: We target high-margin projects with strong rental returns, ensuring a steady stream of income for investors.

• JV Partnerships: We form Joint Ventures (JVs) with experienced local property teams, ensuring that we have the necessary expertise to succeed in any project

Investing in Manchester: High Returns and Strategic Location

Risk management is a critical component of our approach to property development. We take proactive steps to ensure every project is f inancially secure and delivers the desired returns.

- Cash Flow Management: We carefully monitor and manage the financials of each project, ensuring sufficient liquidity at every stage of development.

- Project Selection: Our team selects projects with strong fundamentals, focusing on areas with proven demand and high potential for growth.

- Backup Plans & Exit Strategies: We develop multiple exit strategies, including property sales and refinancing, to ensure that investors have flexibility and options if market conditions change.

Experienced Team: Our team of experts, including surveyors, contractors, and legal professionals, ensures that risks are managed from acquisition through to completion.

Our success is rooted in our extensive network of industry experts and strategic partners. These partnerships enable us to access the best opportunities, manage construction and sales efficiently, and ensure smooth project delivery.

Industry Alliances & Network

- Banks & Financiers: We work with trusted financial institutions to secure project funding and manage capital requirements.

- Sourcing Agents & Surveyors: Our relationships with sourcing agents allow us to identify high-potential properties quickly. Surveyors ensure each property is thoroughly evaluated before acquisition.

- Construction & Contractors: We collaborate with the best construction companies and contractors to ensure high-quality project delivery. Our success is rooted in our extensive network of industry experts and strategic partners. These partnerships enable us to access the best opportunities, manage construction and sales efficiently, and ensure smooth project delivery.

- Local Councils: Close communication with local councils ensures that we stay compliant with planning regulations and receive necessary approvals in a timely manner.

- Selling Agents & Property Management: We partner with local property management companies to handle post sale services, ensuring that properties are well-maintained and profitable for the long term

Why Partner with RockPillar Property Limited

Partnering with RockPillar Property Limited (RPP) offers investors the potential for strong returns, particularly through medium sized conversion projects in Manchester’s booming property market. RPP’s strategic approach involves leveraging bank financing and using a flipping exit strategy, which accelerates capital turnover and increases profitability. The firm’s expertise in identifying and executing these conversions, combined with Manchester’s high demand for property, ensures that investors benefit from both the capital appreciation of the assets and steady financial returns. This makes RPP an attractive partner for those looking to optimize their investments in the UK property sector.

| Key Aspects | |

| Capital Appreciation | Historical property price growth ensures investors benefit from rising values in high-demand areas like Manchester. |

| High ROI | Investors can expect strong returns of 50-70% per year on their investments. |

| Experienced Team | With over 20 years of experience and a wide network of industry contacts, RPP ensures professional management of every project. |

| Risk Mitigation | RPP's risk management strategies include cash flow monitoring and multiple exit strategies, ensuring financial security. |

| Collaborative Approach | RPP partners with local experts, ensuring compliance with regulations and timely project delivery. |

Summary

We welcome visionary entrepreneurs and ambitious companies to explore the multitude of opportunities that our platform can offer. With RockPillar, rest assured that your journey toward financial success is in capable hands.